VAT Rate For Hospitality from 1st October 2021

On 15th July 2020, as part of the government’s measures to help businesses affected by the COVID-19 pandemic, HMRC announced a temporary reduction to the rate of VAT for hospitality, holiday accommodation, and attractions industries.

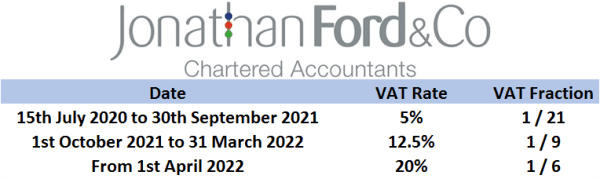

Until 30th September 2021, this was set at a reduced rate of 5%.

From 1st October 2021, a new reduced rate of 12.5% will apply.

This will remain in effect until 31 March 2022, and then the standard rate of 20% is due to return from 1 April 2022.

Example

Assuming your prices include VAT, for a sale of £500, the output VAT owed to HMRC would be as follows:

15th July 2020 to 30th September 2021 – £23.80

1st October 2021 to 31st March 2022 – £55.55

From 1st April 2022 – £83.33