How throwing goods away could save you money

From 1 April there’s a new VAT problem to deal with.

Businesses on the Flat Rate Scheme will have to monitor how much they spend on ‘goods’ each quarter. If they spend more than 2% then they can carry on using the Flat Rate they use now. But, if they spend less than 2% they need to use a special rate of 16.5%.

We’ve lots more information about this in our earlier blog here.

In reality you get some crazy results. Here’s an example:

A business has sales of £24,000 in a quarter (including VAT) and currently pays a flat rate of 12%. It must spend 2% on goods to keep this rate.

If it spends nothing on goods then the VAT payable is £24,000 x 16.5% ie £3,960.

However, if it spends 2% on goods (£480) then the VAT bill is now £24,000 x 12% ie £2,880.

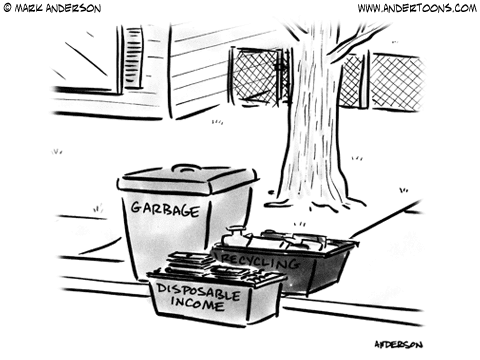

Spending £480 on goods saves £1,080 in VAT! You could, in theory drop the goods in the bin on your ay home from the shop and you’d still be better off by £600 (keep the receipt though!)

In practice we’re finding that there isn’t a one size fits all answer to this. Each business will be different depending on the mix of sales, VAT incurred and the flat rate they’re currently on.

What is for sure is that the Government have made a beautifully simple scheme horrendously complicated.

PS – Some ideas for goods you could buy – printer ink (maybe one of those stupidly expensive colour laser printers), books and magazines (not digital), stationery, workwear (time for a branded sweatshirt!)